irs unveils federal income tax brackets for 2022

8 rows In 2022 the income limits for all tax brackets and all filers will be adjusted for. Previous post Next post.

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

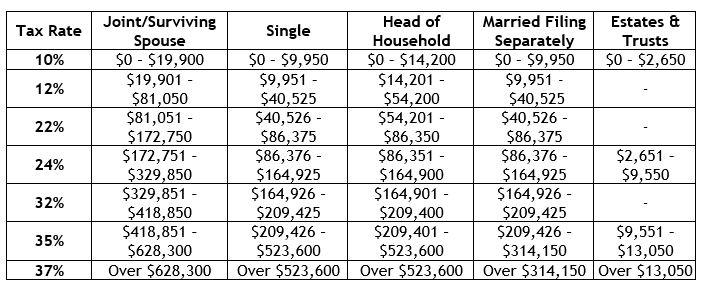

The top marginal income tax rate is 37 percent.

. The amount for heads of household is 55800. The capital gains tax rates will remain the same in 2022 but the brackets will change. The IRS did not change the federal tax brackets for 2022 from what they were in 2021.

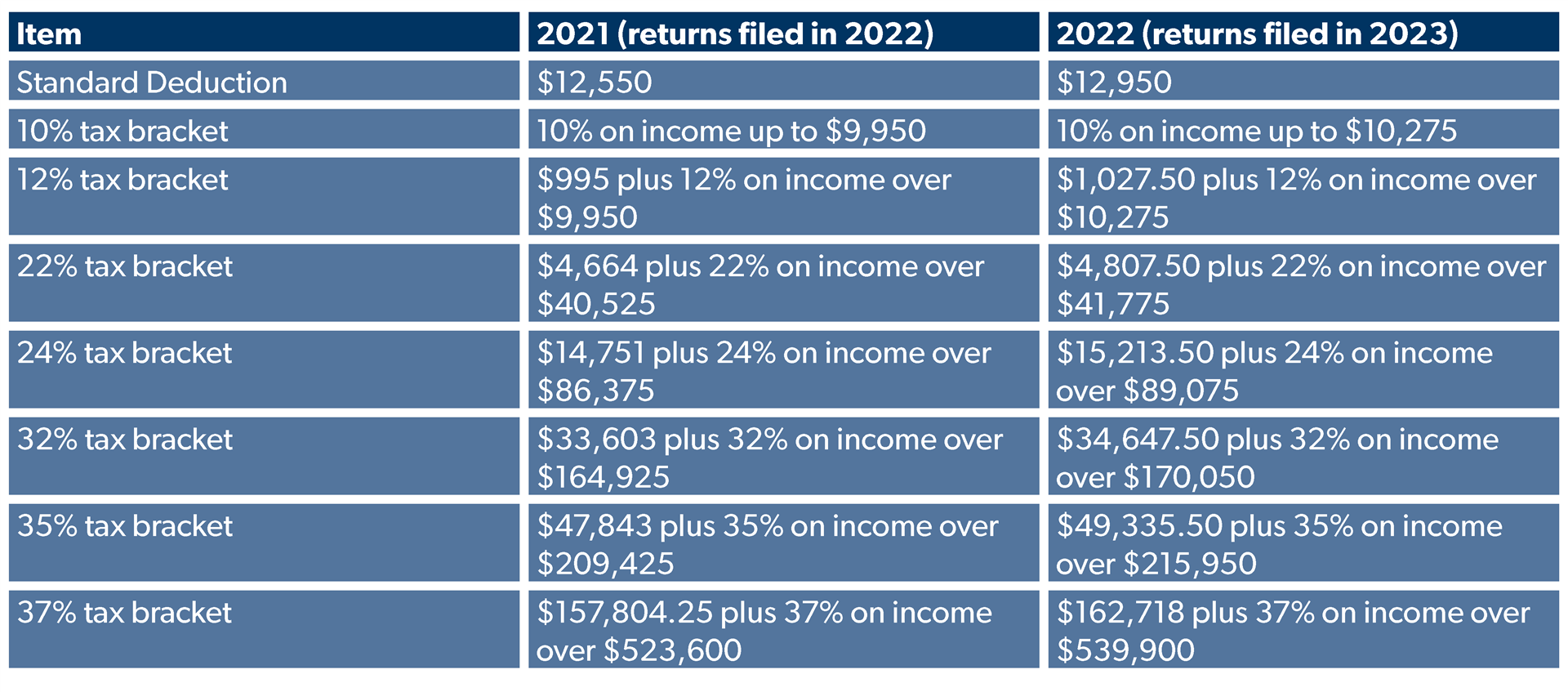

The standard deduction for married couples filing jointly for tax year 2022 rises to 25900 up 800 from the prior year. There is also no limitation on itemized deductions. There are seven tax rates in 2022.

The IRS announced the federal income tax brackets for 2022. 2022 Tax Bracket and Tax Rates. There are seven federal income tax rates in 2022.

2 minutes WASHINGTONThe threshold for the top federal income-tax bracket in 2022 will climb by nearly 20000 next year for married couples and that 37 rate will apply to. Next year taxpayers can put an extra 1000 into their 401k plans. The agency also announced costofliving adjustments that may affect pension plan and other retirement-related savings next year.

The IRS also announced that the standard deduction for 2022 was increased to the following. November 12th 2021 under General News Law Enforcement News PeruRegional History. IRS Tax Tip 2021-170 November 17 2021.

10 of taxable income. The maximum Earned Income Tax Credit is 560 for no children 3733 for one child 6164 for two children and 6935 for three or more children. The personal exemption for tax year 2022 remains at 0 as it was for.

Starting in 2022 the earned income tax credit is. 10 12 22 24 32 35 and 37. Ad Compare Your 2022 Tax Bracket vs.

12950 Heads of households. Discover Helpful Information And Resources On Taxes From AARP. Us irs tax rates 2022.

0 percent for income up to 41675. Taxpayers earning more than 539900 or 647850 are hit this rate. The IRS has announced federal income tax brackets for 2022.

The seven tax rates themselves are unchanged but income limits for each bracket have been adjusted for inflation according to CNBC. 10 12 22 24 32 35 and. For a married.

2022 Tax Brackets Irs Calculator. For 2022 the maximum zero rate taxable income amount will be 83350 for married couples filing jointly and for surviving spouses. 25900 Single taxpayers and married individuals filing separately.

19400 for tax year 2022. The tax items for tax year 2022 of greatest interest to most taxpayers include the following dollar amounts. For married couples filing jointly the proposed 2022 rates work out as follows.

There are still seven in total. The standard deduction claimed by most taxpayers will also increase for 2022 rising to 25900 for married couples filing jointly and to. 10 12 22 24 32 35 and a top bracket of 37.

There are seven federal income tax brackets in 2022. The income limits are unchanged but the cutoff amounts have been increased for inflation. 2022 Federal Income Tax Rates.

There are seven federal tax brackets for the 2021 tax year. The IRS recently announced that the 2022 contribution limit for 401k plans will increase to 20500. Tax bracket ranges also increased meaning many folks may see lower taxes in 2022 if there salary didnt increase beyond 3 to 4.

Heres how they apply by filing status. Then Taxable Rate within that threshold is. As was the case and due to Trumps Tax Cuts and Jobs Acts the the personal exemption remained 0 for tax year 2022.

Listen to article. Here are the new thresholds for the nations seven tax brackets in 2022. 2022 simple federal.

Your 2021 Tax Bracket To See Whats Been Adjusted. The 2022 tax brackets affect taxes that will. 2055 plus 12 of the excess over 20550.

Married couples filing jointly. Single individuals earning up to 10275 and married couples filing jointly earning up to. 7 rows The federal tax brackets are broken down into seven 7 taxable income groups based on your.

The seven tax rates themselves are unchanged but income limits for each bracket have been adjusted for inflation according to CNBC. If Taxable Income is. The IRS has announced new federal income tax brackets for 2022.

For individual single taxpayers. Married Individuals Filling Joint Returns. The 2022 tax brackets affect taxes that will be filed in 2023 CNBC said.

35 for incomes over 215950 431900 for married couples filing jointly 32 for incomes over 170050 340100 for married couples filing jointly 24 for incomes over. Below are the new brackets for 2022 for both individuals and married couples filing a return jointly according to the IRS. These are the rates for.

New 2022 Irs Income Tax Brackets And Phaseouts For

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

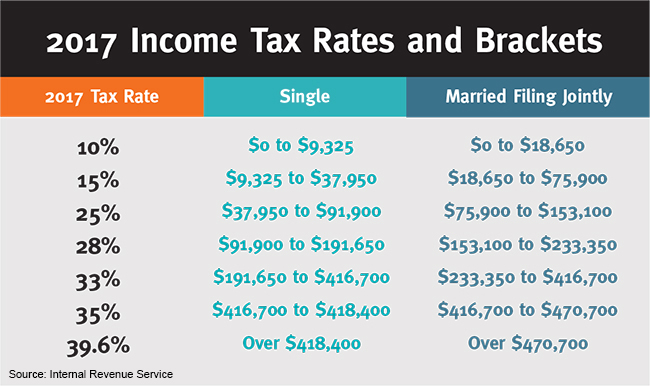

Federal Income Tax Brackets 2012 To 2017 Novel Investor

The Rich Pay A Lot In Taxes American Experiment

Irs Announces Inflation Adjustments To 2022 Tax Brackets Foundation National Taxpayers Union

Tax Brackets Will Be Higher In 2022 Due To Faster Inflation Irs Says Tax Brackets Irs Taxes Irs

2020 Year End Tax Planning Highlights For Individuals Dalby Wendland Co P C

Will The Irs Extend The Tax Deadline In 2022 Marca

Roth Ira Traditional Ira Contribution Limits For 2021 And 2022 Tax Brackets Standard Deduction Irs

The Irs Releases New Withholding Tables For 2018 In Wake Of Tax Reform Law

Us Tax Changes For 2013 And 2014 Us Tax Financial Services

Fundamentals Of Income Taxes Financial Fitness Association

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Irs Announces 2022 Inflation Adjusted Tax Rates For Individuals By Jack Winter Cpa Pfs Cfp Berkowitz Pollack Brant Advisors Cpas